Benefit In Kind Malaysia 2018 Car

Assets provided to employees for private usage phone furniture fittings household appliances etc.

Benefit in kind malaysia 2018 car. Car and related benefits provided to employees for private usage. If the total amount of loan exceeds rm300 000 the amount of subsidized interest to be exempted from tax is limited in accordance with the following formula. Summary of changes 1 3.

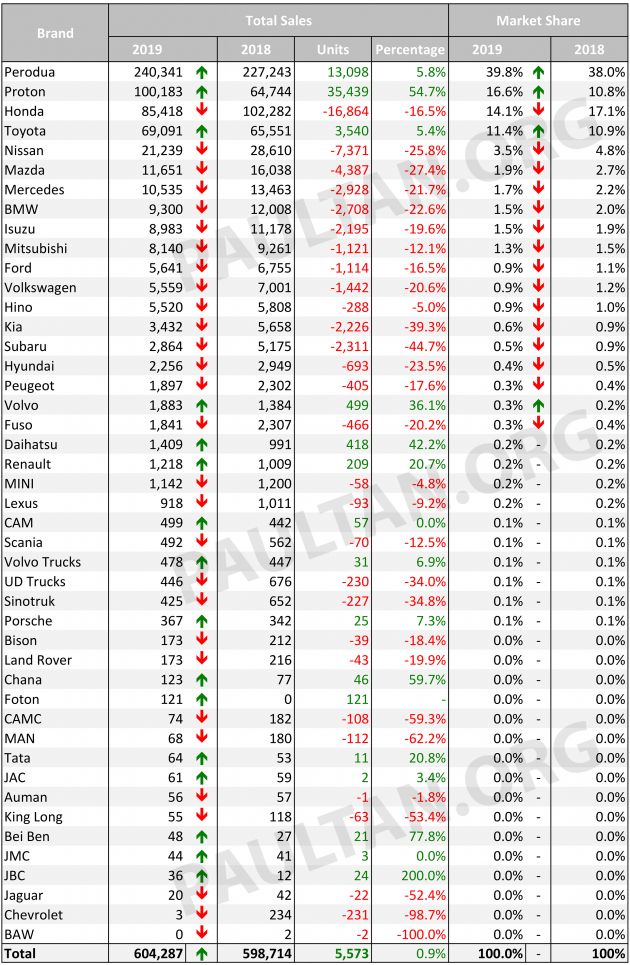

Or you can use hmrc s company car and car fuel benefit calculator if it works in your browser. It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and procedure that are to be applied. Types of benefits in kind based on the formula method rm based on the prescribed value method rm motorcar 180 000 x 80 18 000 8 9 000 petrol 8 900 actual.

15 march 2013 contents page 1. Common benefits in kind biks some of the common biks include. Cost means the actual cost incurred by your employer or the market value of the asset.

Cost of the car x 80 annual value of benefit of car 8 years prescribed average lifespan under this method an abatement of 20 is given which is deemed to be the value of the car at the time it is returned to the employer by the. The annual value of benefits in kind on car and petrol for the year of assessment 2007 is computed as follows. A ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia.

Inland revenue board of malaysia benefits in kind public ruling no. Generally the annual value of a given bik provided by your employer is computer by reference to the following formula. Residential accommodation provided to employees.

Choose fuel type f for diesel cars that meet the euro 6d standard. 2 2004 date of issue. 3 2013 date of issue.

A ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new. A is the difference between the amount of interest to be borne by the. Benefits in kind third addendum to inland revenue board malaysia public ruling no.

17 april 2009 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board. 19 april 2010. The cost of the motorcar is rm81 000.

Based on the formula method. 2 2004 date of issue. Inland revenue board malaysia benefits in kind fourth addendum to public ruling no.

Computation of bik. Subsidised interest for housing education or car loan is fully exempted from tax if the total amount of loan taken in aggregate does not exceed rm300 000. Ascertainment of the value of bik 3 7.

The benefit is provided to him throughout the year 2018. Prescribed average life span of asset. Cost of the asset providing benefit amenity annual value of benefit.

Benefits in kind third addendum to public ruling no. Related provisions 1 4. Inland revenue malaysia has provided the following two methods to compute the annual value of bik.